Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

The Acid-Test Ratio, also known as the quick ratio, is a liquidity ratio that measures how sufficient a company’s short-term assets are to cover its current liabilities. In other words, the acid-test ratio is a measure of how well a company can satisfy its short-term (current) financial obligations. This guide will break down how to calculate the ratio step by step, and discuss its implications.

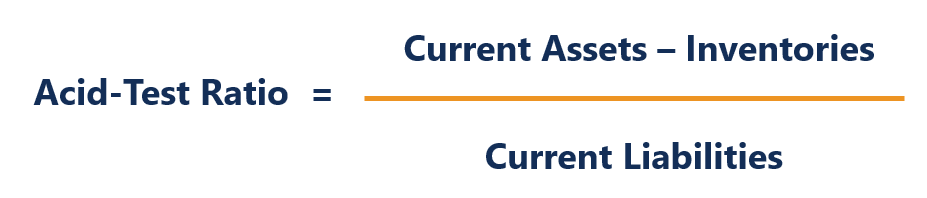

The formula for calculating the ratio is as follows:

The following items can all be found on a company’s balance sheet:

The acid-test ratio formula can alternatively be rendered as follows:

The logic here is that inventory can often be slow moving and thus cannot readily be converted into cash. Additionally, if it were required to be converted quickly into cash, it would most likely be sold at a steep discount to the carrying cost on the balance sheet.

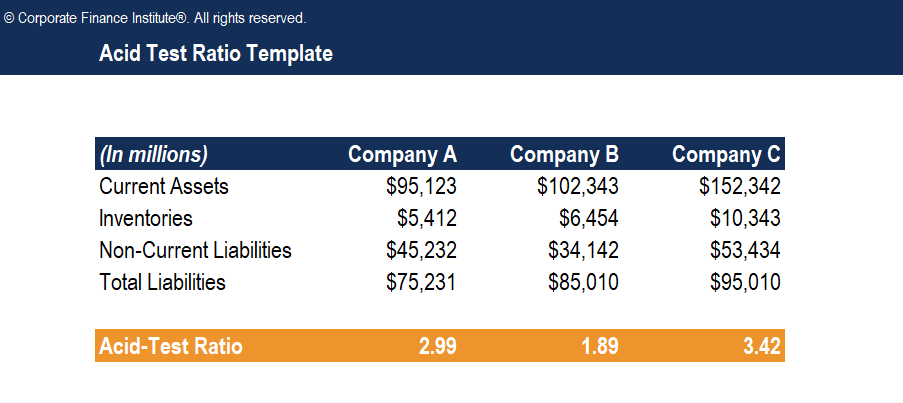

Consider three hypothetical companies:

Here are the calculations of the acid-test ratio for each company:

Note: To determine the current liabilities for each company, total liabilities are subtracted from non-current liabilities.

Enter your name and email in the form below and download the free template now!

Download the free Excel template now to advance your finance knowledge!

The acid-test ratio is used to indicate a company’s ability to pay off its current liabilities without relying on the sale of inventory or on obtaining additional financing. Inventory is not included in calculating the ratio, as it is not ordinarily an asset that can be easily and quickly converted into cash. Compared to the current ratio – a liquidity or debt ratio which does include inventory value in the calculation – the acid-test ratio is considered a more conservative estimation of a company’s financial health.

The higher the ratio, the better the company’s liquidity and overall financial health. A ratio of 2 implies that the company owns $2 of liquid assets to cover each $1 of current liabilities. However, it’s important to note that an extremely high quick ratio (for example, a ratio of 10) is not considered favorable, as it may indicate that the company has excess cash that is not being wisely put to use growing its business. A very high ratio may also indicate that the company’s accounts receivables are excessively high – and that may indicate collection problems.

The optimal acid-test ratio number for a specific company depends on the industry and marketplaces the company operates in, the exact nature of the company’s business, and the company’s overall financial stability. For example, a relatively low acid-test ratio is less significant for a well-established business with long-term contract revenues, or for a business with very solid credit, so that it can easily access short-term financing if the need arises.

As with virtually any financial metric, there are a number of limitations and potential drawbacks to using the quick ratio:

Thank you for reading CFI’s guide to Acid-Test Ratio. To keep advancing your career, the additional CFI resources listed below will be useful:

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.